Kentucky has a historic opportunity to invest in critical community needs, but the House passed a modest budget – lacking adequate funds for areas like education, child care, housing and Medicaid – that instead grows already ample reserves and aims for potential additional income tax cuts. To try to hit those triggers, which require continued underspending relative to revenues, the House’s legislation suspends the law determining if the triggers are met by ignoring nearly $900 million in spending on infrastructure and other one-time items. In addition, the House budget keeps overall spending down relative to revenues, despite making $1.45 billion in pension contributions above the actuarially determined amount, in part by issuing additional debt rather than using more of the ample cash reserves available.

That underspending adds even more money to the already overfunded Budget Reserve Trust Fund (BRTF). The BRTF balance would grow from $3.7 billion today to approximately $5.2 by the end of the biennium under the House plan.

The budget now moves on to the Senate.

Budget makes possible income tax cuts in 2026 and 2027, suspends trigger rules and uses debt rather than cash to make that more likely

It is likely that the state will hit its income tax trigger for fiscal year 2024, which if the legislature approves a cut in the 2025 legislative session will result in a reduction of the income tax rate from 4% to 3.5% on Jan. 1, 2026. Language in the House budget already anticipates a reduction in revenues of $359 million in 2026 as a result. Based on the appropriations included in the House budget bills and suspension of the law described below, it is also possible the triggers will be hit in fiscal year 2025, though it will be very close. If the triggers are hit and the cut is approved by the legislature, the income tax rate would drop from 3.5% to 3% on Jan. 1, 2027.

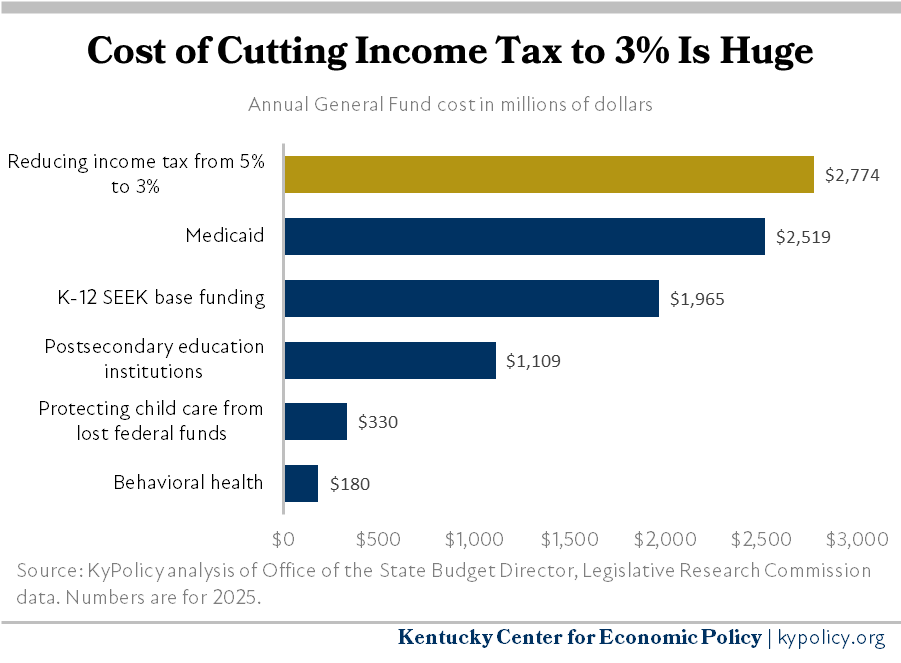

If that happens, nearly one in six total state General Fund dollars will have been eliminated through recent income tax reductions, exceeding the 11% cuts that Kansas made (and then was forced to reverse) in the early 2010s. A cumulative cut in the income tax rate from 5% in 2022 to 3% would cost more General Fund dollars than Kentucky spends on the entire Medicaid program, which provides health insurance for 1.5 million people.

There are three ways in which the House budget is designed to trigger more of those expensive tax cuts. First, it “notwithstands” or suspends the trigger law to ignore nearly $900 million in new spending on infrastructure and other one-time items, not counting this spending toward whether the trigger is met. Supporters of the formula have maintained that it is working as intended despite the triggers not being hit this year, but the House’s budget suspends the existing rules to make hitting them easier.

That nearly $900 million is contained in House Bill (HB) 1 while most of the rest of the executive branch appropriations are in HB 6. HB 1 also includes $950 million in extra pension contributions, though those already do not count toward income tax triggers.

HB 1 includes the following appropriations:

- Teachers Retirement System unfunded liability: $500 million

- Matching grants for federal infrastructure monies: $450 million

- Kentucky Employees Retirement System nonhazardous unfunded liability: $300 million

- Water and wastewater infrastructure: $150 million

- State Police Retirement System unfunded liability: $150 million

- Cabinet for Economic Development loan pool and projects: $125 million

- Cabinet for Economic Development mega-projects: $100 million

- Highways projects: $30 million

- Department of Aviation: $11.4 million

- Kentucky State Police lab equipment: $6.4 million

Second, the House budget issues additional debt to spend on various infrastructure needs rather than using more of the ample cash available in reserves. The House budget contains $2.7 billion in debt using bond funds, while the governor’s budget included $1.7 billion. Borrowing only adds annual debt service payments to current spending, rather than the full cost of a project. So borrowing allows additional spending that meets public needs and satisfies constituents but has little impact on whether the tax cut triggers in the new budget are met. And it makes the cost of projects more expensive over time because it adds interest payments, and interest rates have increased recently. Using debt to spend money while still hitting the tax cut triggers was also a tactic used in the last budget.

Third, the House budget keeps austere appropriation levels for a variety of public services in order to keep overall spending significantly below revenues. Spending in fiscal year 2025 (not counting the $1.7 billion in HB 1 from the BRTF, new appropriations to the BRTF, and $250 million in extra pension contributions included in HB 6 which do not count toward the triggers) is approximately $1.4 billion less than revenues expected to be received, making hitting the triggers in 2025 possible. Spending is also less than revenues in fiscal year 2026, but not by enough to make hitting the triggers that year likely.

This underspending relative to revenue will continue to grow the already-overfunded BRTF. In total, it will climb from $3.7 billion today to an estimated $5.2 by the end of the biennium under the House budget. While 15% of an annual budget is considered a strong rainy day fund, Kentucky’s would grow to approximately 32%.

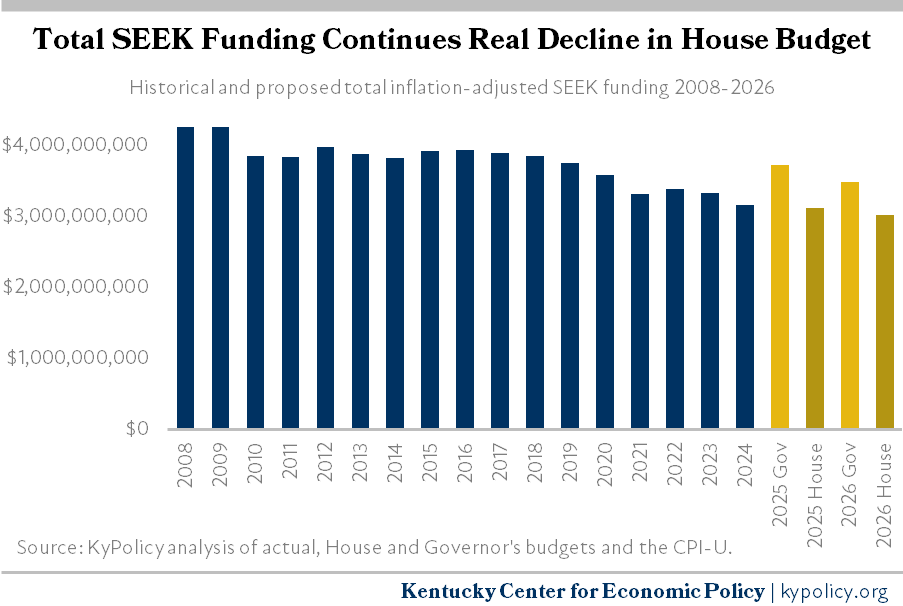

SEEK funding doesn’t keep up with inflation, no dedicated teacher raise, but does fully fund student transportation

By not including dedicated teacher and school employee raises as in the governor’s proposed 11% increase, and by increasing core K-12 school per pupil funding (SEEK) by only modest amounts, SEEK again does not keep up with inflation in the House budget. Real total SEEK funding falls from 26% below 2008 levels in 2024 to 29% below by 2026. The base per pupil guarantee increases by 4% in the first year of the budget and 2% in the second year. But that’s a state plus local number, and strong state-wide property assessment growth means a significant portion of that increase is being paid at the local level.

The House budget increases the funding for school transportation to 80% of the statutorily required amount in 2025 and 100% in 2026. If it remains in the final budget, 2026 will be the first year since 2004 that transportation was fully funded by the General Assembly.

The budget does not include additional funds for preschool, which is still funded at its 2019 level ($84.5 million). The governor had proposed universal preschool for four year-olds with an added cost of $172 million annually. Extended school services (afterschool programs) are also at the same level as in 2019. The budget flat-lines funding for mental health services, and does not include a proposed $6.2 million each year for social and emotional learning and health included in the governor’s plan. The House budget adds $16.5 million each fiscal year to fund school resource officers that was not in the governor’s proposal. And the House budget proposes adding $4 million each fiscal year to support the operations of additional Family Resource and Youth Services Centers (FRYSCs), though that is half the amount added in the governor’s proposal for additional FRYSCs.

There are no funds for teacher professional development, which has not been specifically funded since 2018, or for textbooks. The budget does not include $150 million contained in the governor’s proposal to address inflation in existing school facility construction projects. There is $4.8 million per year in a pilot program of teacher student loan forgiveness, though that is less than the $26.3 million a year the governor had proposed. The budget includes $750,000 for an audit of Jefferson County Public Schools, and contains language that raises the threat of takeovers and school closures if schools do make adequate progress on teacher recruitment and retention.

In total, the House budget includes 14% less on P-12 spending than the governor had proposed, or $1.5 billion less over the biennium.

Budget includes increase for higher education, full funding of need-based college aid

The House budget increases base funding for higher education by 3% the first year and 6% the second and puts $101 million each year in the performance funding pool, which has tended to provide little to no aid to institutions with more low-income students and students of color. However, the budget does provide additional dollars to Kentucky State University, which has long been inequitably underfunded as identified by the federal government in a recent letter to the state. Yet the state’s higher education institutions are still funded at a level 31% below 2008 by the end of the biennium. As in the last budget, the House budget does include full funding of the lottery-supported need-based college scholarship programs.

Plan includes much smaller raises for state employees, no increase for retirees, massive pension liability contributions

The House plan does not include any cost of living adjustment or payment for state retirees, whereas the governor’s plan had included $100 million for an additional retirement check to help address the fact retirees haven’t received a cost of living adjustment in their pensions since 2012.

The House budget includes a 4% raise the first year of the budget for state employees, and a 2% raise the second year. That’s smaller than the governor’s proposed 6% raise in 2025 and 4% in 2026. The House also does not include funds to address wage compression, a situation in which many long-term employees do not make much more than newer employees due to years without raises. The governor had proposed additional raises of 1% to 7% to deal with that issue. The House instead mandates another study of the issue (the third such report), this time by an independent consultant, to be completed by December 2024.

On top of the significant appropriations to unfunded liabilities in HB 1 mentioned above, HB 6 includes $500 million in additional funds to the Kentucky Employees Retirement System non-hazardous pension fund, for a total of $1.45 billion on top of the actuarially determined contribution to the state’s retirement systems. The governor’s plan had included $209 million above the actuarially determined contributions.

Plan includes too little child care funds, Medicaid

The House budget includes $30 million in additional monies for child care in 2025 and $40 million in 2026 in light of the coming cliff with the end of federal pandemic funds, far short of the estimated $330 million Kentucky needs to fully replace those funds. These monies hold the child care provider reimbursement rate at the 80th percentile of market rate, but the budget does not include funds to maintain the stabilization payments, the higher income eligibility threshold for the Child Care Assistance Program, or even the successful program that allows child care workers to take advantage of subsidies.

The budget also shorts the funding for the Medicaid program for fiscal year 2025 by veering from the forecast the administration used about enrollment and costs without a clear reason as to why. In addition, the House reduced the amount provided to update nursing home facility rates in 2025, potentially delaying those reimbursements for a year, shifted the fund source for other expenditures, and removed approximately $2.7 million a year for Mobile Crisis Intervention Services that was to provide emergency mental health services in homes and communities. In total, the House budget shorts Medicaid by $127 million in General Fund dollars and $57 million in restricted funds in 2025 resulting in a $922 million shortfall once matching federal funds are taken into account. The administration will likely be forced to reduce services, provider payments and/or enrollment in 2025 if additional funds are not appropriated.

The budget does include $60.7 million for 2,550 new Medicaid slots among four different waiver programs that care for people with disabilities, significant progress on a waiting list that includes more than 12,000 Kentuckians. The House budget also includes $94 million over the biennium to improve reimbursement rates to waiver service providers. The budget creates two new Medicaid community-based waiver programs using General Fund dollars — one for people with co-occurring serious mental illness and substance use disorder, and another for children with various disabilities.

The proposal includes an increase in both the foster care and relative caregiver payment rates at amounts similar to what the governor had proposed, and $10 million each year for senior meals to prevent a waiting list (the same as the governor’s plan). The House includes $1.5 million each year for the required administrative match to implement Kentucky’s federally-funded Summer EBT program, which provides food assistance to students in the summer who qualify for free and reduced meals during the school year. But the House does not include $2.5 million per year in state aid for local libraries that was included in the governor’s plan.

No additional monies for housing or disaster relief, less for clean water needs

The budget includes no funds specifically for affordable housing. Advocates have called for $200 million to spend on rural and state-wide affordable housing needs. The House also doesn’t include the $75 million the governor had included for additional disaster relief in eastern Kentucky following the 2022 floods. In a separate bill (HB 262), the House caps what can be spent on necessary emergency disaster aid this year at $75 million rather than allowing the needed funds to be spent. A separate House resolution releases $62.5 million of $71 million previously appropriated for much-needed state parks renovation.

The House budget includes $150 million for water and wastewater infrastructure, significantly less than the governor’s proposed $500 million plus $30 million in assistance to local entities (though some of the $475 million in matching grant funds in HB 1 could be used for water and wastewater infrastructure). The House budget also does not include $12 million earmarked for Martin County water projects included in the governor’s budget to help address that county’s severe clean drinking water problem. The transportation budget lacks $300 million for the Mountain Parkway widening and I-65 Ohio River crossing that were included in the governor’s budget, and $25 million from the General Fund for a county and city bridge improvement program that is funded in the House budget through Road Fund dollars.

Budget zeroes out funding for award-winning diversion program, provides additional funds for prosecutors but not public defenders

The latest version of the budget entirely eliminates funding for the Alternative Sentencing Worker Program (ASWP) in the Department of Public Advocacy. ASWP program is a highly effective program that connects people to drug treatment and mental health services as an alternative to incarceration. In 2013, it was named one of the “top 25 innovations in government” nationwide by the Harvard Kennedy School.

Prosecutors receive additional funding in both years of the biennium, including $5 million in each year for additional personnel and $6.5 million over the biennium for salary compensation standardization for Commonwealth’s Attorneys, along with $5.5 million in each year for additional personnel and $17 million over the biennium for salary compensation standardization for county attorneys. There are no new appropriations in the House plan for comparable increases for public defenders.

Additional support is provided for the Department for Juvenile Justice for increased alternatives to detention programming at $7.8 million a year, and $3.5 million is provided each year for other programs including social service specialists. In addition, funding is provided to support renovation of two detention facilities in Louisville. Also, the Governor’s budget includes funding to retrofit an existing facility to provide inpatient mental health treatment services to children served by both the Department for Juvenile Justice and the Cabinet for Families and Children. The House budget does not include this funding.

The House budget does not include the over $5 million a year for improved re-entry services for those leaving prison and jail that was in the governor’s plan. It continues the $4 increase in the per-diem amount in the previous biennium for county jails for each person serving a felony sentence (up from $31.34 per day to $35.34 per day).

Updated March 6, 2024 to reflect the introduced transportation budget.